Mortgage calculator with down payment and extra payments

Another technique is to make mortgage payments every two weeks. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees.

. An additional 50 or even 25 extra principal each month may make a surprising difference. Using my Mortgage Payoff Calculator Extra Payment. Refinance your existing mortgage to lower your monthly payments.

Term of the loan. Your mortgage can require. Found on the Set Dates or XPmts tab.

2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. The CUMIPMT function requires the Analysis. How Do Bi-Weekly Payments Work.

This calculator determines your mortgage payment and provides you with a mortgage payment schedule. Is approaching 400000 and interest rates are hovering around 3. The NPER formula is used to calculate the number of payments required to pay off the mortgage taking into account extra payments.

You will therefore make 26 payments a year the equivalent of one extra monthly payment a year. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. Initial loan amount.

According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. To learn more about other types of extra payments visit the extra payment mortgage calculator.

Extra payments count even after 5 or 7 years into the loan term. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. The monthly interest payment will go down each month.

If you receive extra money such as a work bonus tax refund or. For Excel 2003. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months.

You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time youll save if. Mortgage Closing Date - also called the loan origination date or start date. See our current mortgage rates low down payment options and jumbo mortgage loans.

The amount of time youve agreed to pay off your mortgageFor example a 30-year mortgage would have a loan term of 30 years. The minimum down payment in Canada is 5. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

For down payments of less than 20 home buyers are required to purchase mortgage default insurance commonly referred to as CMHC insurance. Check out the webs best free mortgage calculator to save money on your home loan today. He has tracked down all his expenditures and found a way to extra pay 2000 a month with the regular payment of his mortgage loan.

Minus the down payment plus any applicable mortgage loan insurance premium you have to pay. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side.

Mortgage calculator with extra payments can help you understand how you could save money and payoff your mortgage early by making additional mortgage payments. Ultimately significant principal reduction cuts years off your mortgage term. Down payment The amount of money you pay up front to obtain a mortgage.

Our calculator includes amoritization tables bi-weekly savings. You can also see the savings from prepaying your mortgage using 3 different methods. How much you originally borrowed to purchase your homeWhen you make extra mortgage payments youre reducing this initial loan.

If the first few years have passed its still better to keep making extra payments. Minimum down payments vary from 5 to 20 depending on location. Biweekly mortgage calculator with extra payments Free Excel Template Save Saved Removed 0.

Mortgage calculator - calculate payments see amortization and compare loans. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. How to Use the Mortgage Calculator.

There are optional inputs in the Mortgage Calculator to include many extra payments and. Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. First Payment Due - due date for the first payment.

A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in an estimated principal and interest monthly payment of 99472 over the full term of the loan with an Annual Percentage Rate APR of 3444. Make more frequent payments. Whatever the frequency your future self will thank you.

Plan your mortgage payments today. Mortgage Amount or current balance. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Down payment in dollars. The main reason borrowers choose biweekly payments over monthly payments is that biweekly payments allow them to pay off their mortgage earlier and hence save a lot of money on interest payments over the years.

Whats more our monthly mortgage calculator with down payments provides the borrower with clear results breaking down the loan and monthly payment into its constituent parts to make it easier to. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Conforming Fixed-Rate estimated monthly payment and APR example.

If you want to calculate how much you would save by paying more or less of an extra payment simply press the back button and you can modify the extra payment amount. A down payment is the amount of money including deposit you put towards the purchase price of a property. Total saved How much you will save in interest by making extra payments consistently.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. Estimated monthly payment and APR calculation are. 1 866 934-7283 Phone Call.

Total of 360 Mortgage Payments. Calculate what your mortgage payment could be. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

With extra payment The total cost of loan plus interest if extra payments are made.

Extra Payment Calculator Is It The Right Thing To Do

Free Interest Only Loan Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Extra Payment Calculator Is It The Right Thing To Do

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Extra Payment Mortgage Calculator For Excel

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Biweekly Mortgage Calculator How Much Will You Save

Downloadable Free Mortgage Calculator Tool

Extra Payment Calculator Is It The Right Thing To Do

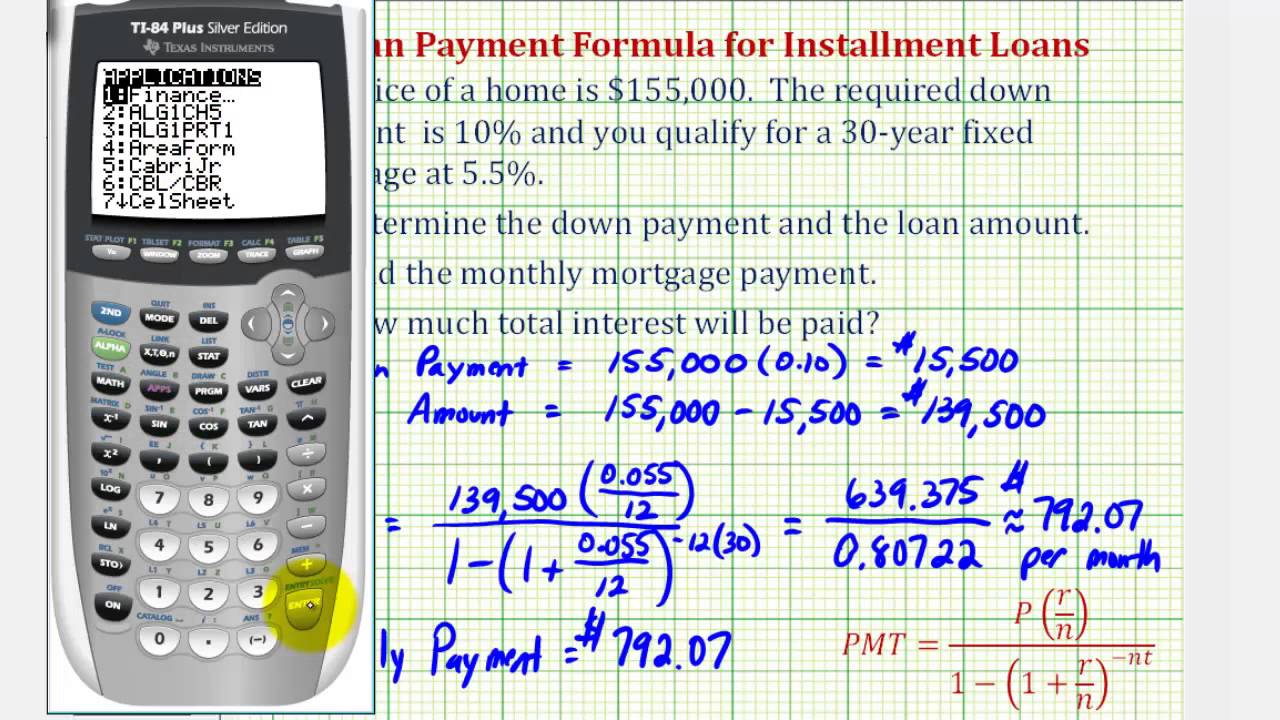

Ex 1 Find A Monthly Mortgage Payment With A Down Payment Youtube

Mortgage Payoff Calculator With Line Of Credit